As we step into 2025, the United States economy is poised for significant changes, with a keen eye on the Consumer Price Index (CPI) and inflation rates. The CPI, a crucial indicator of inflation, measures the average change in prices of a basket of goods and services consumed by households. In this article, we'll delve into the projected 2025 CPI and inflation data for the United States, exploring trends, forecasts, and potential impacts on the economy.

Current State of Inflation in the US

The US inflation rate has been a topic of discussion in recent years, with the COVID-19 pandemic and subsequent economic stimulus packages contributing to fluctuating prices. As of 2024, the annual inflation rate stands at approximately 2.5%, slightly above the Federal Reserve's target rate of 2%. The CPI has been steadily increasing, driven by rising costs of housing, healthcare, and food.

2025 CPI Projections

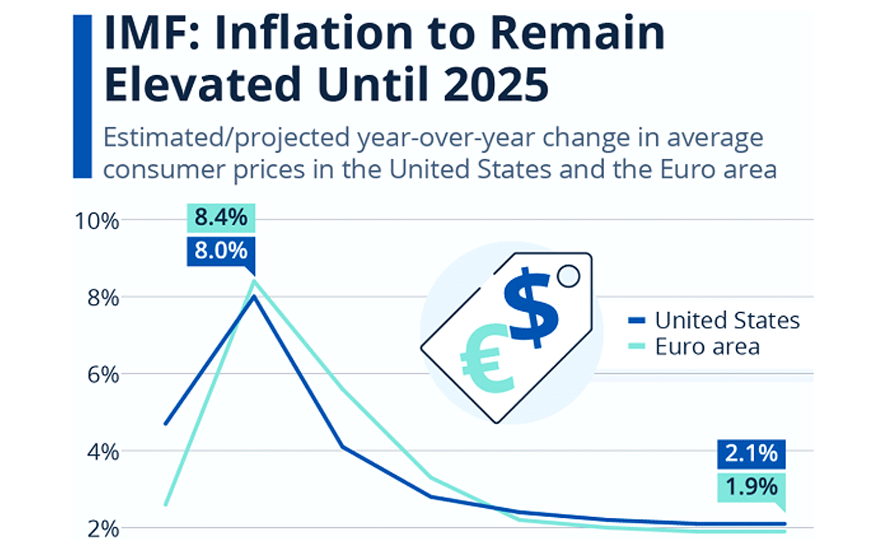

According to forecasts from reputable sources, including the International Monetary Fund (IMF) and the Congressional Budget Office (CBO), the 2025 CPI is expected to rise moderately. The projected annual inflation rate for 2025 is around 2.8%, with a possible range of 2.5% to 3.1%. This increase is attributed to:

Wage growth: As the labor market continues to strengthen, wages are expected to rise, driving up production costs and, subsequently, prices.

Supply chain disruptions: Ongoing global supply chain issues, particularly in the technology and automotive sectors, may lead to higher prices for goods.

Energy prices: Fluctuations in global energy markets, including oil and natural gas prices, will influence inflation rates.

Impact on the US Economy

A moderate increase in inflation can have both positive and negative effects on the US economy. On the one hand, a controlled rise in inflation can:

Boost economic growth: Moderate inflation can stimulate spending and investment, as consumers and businesses anticipate future price increases.

Support job market: A growing economy can lead to higher employment rates and increased consumer confidence.

On the other hand, high inflation can:

Erode purchasing power: Rising prices can reduce the purchasing power of consumers, particularly those living on fixed incomes.

Increase borrowing costs: Higher inflation can lead to increased interest rates, making borrowing more expensive for consumers and businesses.

As we look ahead to 2025, the US inflation outlook appears to be moderate, with a projected CPI increase of around 2.8%. While a controlled rise in inflation can have positive effects on the economy, it's essential to monitor the situation closely to avoid potential negative consequences. The Federal Reserve will likely continue to play a crucial role in managing inflation, using monetary policy tools to maintain economic stability. As the year unfolds, we'll be keeping a close eye on CPI and inflation data to provide updates and insights on the US economy.

Key Takeaways:

2025 CPI projected to rise moderately to around 2.8%

Wage growth, supply chain disruptions, and energy prices will influence inflation rates

Moderate inflation can stimulate economic growth and support the job market

High inflation can erode purchasing power and increase borrowing costs

Stay tuned for further updates on the US economy and inflation outlook.